What would that feel like?

Keeping track of business costs

There are a lot of great perks from working from home or having your own business. As your business grows you will start to acquire some business expenses. Keeping track of these expenses is a very important part of your ongoing success in your business.

Why you ask? Well there is a lot of in-depth details we can get into in regards to business expenses and tax write offs, but to scratch the surface and help paint the picture for you, keeping track of all your business expenses can give you some great tax relief at the end of the year. For the first year you can probably keep track of most of your expenses your self, I would recommend scheduling it in for every Friday morning, or another day if it works better for you. Just make sure you keep on top of it. Doing it weekly will help keep it more organized, and will insure you don’t miss things or loose receipts. Once you start to notice your expenses increasing a lot with your income, I would highly recommend getting in touch with a good accountant and have them as part of your business team. Having solid book keeping and tax records are a key part to a successful business.

Your accountant can give you all sorts of advise about tax savings and expenses that you want to have to support the business. There services at the end of the year are also tax deductible. Any business person will tell you that a good accountant and clean book keeping can sometimes make or break your business. Every dollar counts, don’t miss out on tax savings!

So now you are wondering… what are some things you can write off, and what sort of expenses should you be keeping track of?

– Dining out: when you dine out and meet with clients or business partners, those meals are tax deductible. Keep those receipts. As long as it’s in some way work related it counts as a business expense

– Car: if you travel for work, and I don’t mean across country, if you are driving to meet clients or customers, or you are going to meet with suppliers or research new products, every time you use your car for work purposes the km are deductible. A portion of your car payments and insurance can be added to your business expenses along with any up keep required to keep it running smoothly and safely

– Mortgage and home expenses: when your business base is your home you are able to write off a portion of your mortgage and utility bills to your business expenses. You can also add any internet, phone and cable expenses as well. In order to calculate what percentage of your home is tax deductible, you need to figure out what percentage of your total homes square footage is dedicated to your home business space, that percentage represents how much of your mortgage and utility costs can be added to your tax deductions.

– Business: any and all expenses related to your business, stationary, business cards, flyers, advertising… and the list goes on, anything you spent money on to help grow your business can be tax deductible.

So what’s tax deductible. Well when you are an employee of a business your income is taxed first and then you keep the rest. Business tax I structured differently. Your expenses come off of your gross income and then your taxes are paid on the income left over after that. Again there is a lot more detail involved in tax, which is why I strongly suggests seeking professional help, but for the purpose of this post, I’m merely trying to open your eyes to the potential and the importance of good book keeping and keeping track of your expenses

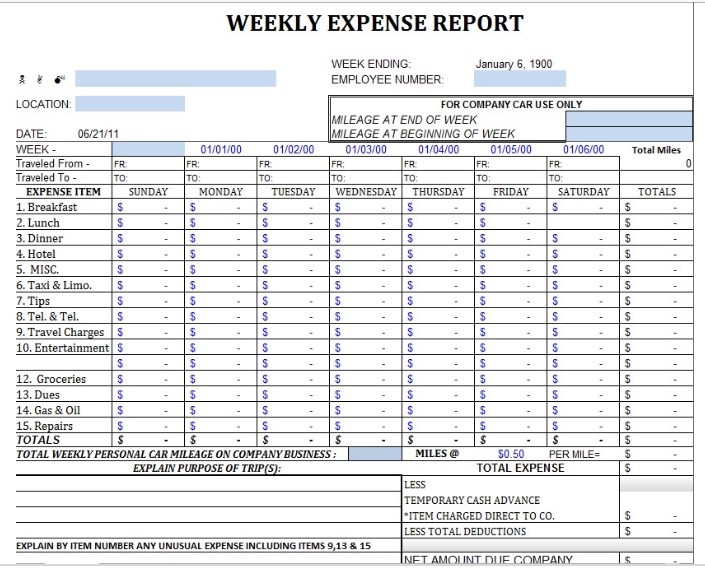

How do I keep track? Keeping track can be very simple when done regularly. For example I do my expenses every Friday morning before I get into my daily routine. I open up a spread sheet I created for the month, and plug in all my expenses for that week in. The first column is the date, and then I have a volume for food, car, business etc to follow, and the plug in the totals from all the receipts I have. If your good with spread sheets you can create a formula to have to totals auto populate at the bottom of the page in a spot marked totals, if not, just manually calculate and have a totals column the end of each day and then add them all up at the end of the month. Create your spread sheet to reflect your businesses specific needs, what works for me may not work for you. Keep all your receipts you collected and staple them together, and then put them in a folder marked for that particular month. At the end of the month print off your expense sheet add it to the folder along with anything else you collected for your expenses including utility and internet/ phone bills and file it all away safely for tax season.

The key it to keep on top of it!

I can’t stress to you enough how important it is to keep on top of your book keeping. Trust me, you will thank me in tax season when you go to do your taxes and everything is organized and filed properly, and things go more smoothly.

You work hard for your money, don’t leave anything left on the table.

If you have any questions or some great organizing tips you use for your book keeping please leave a comment below and share it with everyone. Thanks for reading…